Personal Loans to fit your lifestyle

Get money for what you need and reach your goals faster with Arizona Financial's Personal Loans.

Borrow Smarter with Arizona Financial

When you're a member of Arizona Financial, you're more than just a credit score. Our loan specialists work with you to find the right loan for your needs at rates and payments you can afford.

PERSONAL LOANS

- Closed-End Personal Loan

- Revolving Line of Credit

(Revolving, open-ended loan with low, variable rates) - Share Secured Personal Loan

(Use the money you have on deposit to secure the loan) - Sallie Mae Smart Option Student Loan

AUTO LOANS

- New & Used Auto Loans

- Auto Refinancing

- Let our experts find the vehicle you want with Members’ Auto Center. Qualify for a 0.25% discount on your Arizona Financial auto loan

- Our team can help you find a great deal on your Auto Insurance policy, plus you may qualify for an additional 0.25% discount on your Arizona Financial auto loan*

* Must purchase insurance policy within 30 days of loan funding to receive discount. Insurance products and services are offered through Arizona Federal Insurance Solutions, LLC, and are not products, services or obligations of Arizona Financial Credit Union. Insurance products and services are not insured by the NCUA and have no credit union guarantee.

RECREATION VEHICLES

- Utility Vehicles – ATVs & UTVs

- Watercraft – Boats & Jet Skis

- Motorcycle Loans

- RV Loans – Campers, Motorhomes & Fifth Wheel

MORTGAGE & HOME EQUITY LOANS

- Buy or refinance a home with a Conventional, FHA, VA or Jumbo loan

- Explore a lot or construction loan to buy or build your dream home

- Unlock the equity in your home with a Home Equity Loan or Line of Credit

Personal Loan Rates

Our low fixed personal loan rates offer an affordable and stable payment that fits into your budget.as low as

Amount

as low as

Amount

as low as

Amount

as low as

Amount

*Annual Percentage Rate. APR shown is the lowest available rate. Actual APR based on borrower’s credit history, collateral and loan terms. Membership required based on eligibility. Loan payment example: $32.62 per month for each $1,000 borrowed at 10.75% APR for 36 months. Not all applicants may qualify.

*Annual Percentage Rate. APR shown is the lowest available rate. Actual APR based on borrower’s credit history, collateral and loan terms. Membership required based on eligibility. Loan payment example: $32.62 per month for each $1,000 borrowed at 10.75% APR for 36 months. Not all applicants may qualify.

Get Started

- Apply online, get quick decision

- Loans for what you need

- No application fee

- Low rates, flexible terms

Personal Loans are Flexible & Fast

Have confidence that your agreed-upon affordable payment will not increase for the duration of your loan term.

Explore your options and apply today without having to pay an application fee.

Paying your loan off early should be your ultimate goal! We'll celebrate with you when you make your final payment.

Apply online 24/7, and enjoy our simple application and local, fast decision-making and loan approvals.

FIND THE PERFECT PAYMENT

Personal Loan Calculator

Explore your payment options with an Arizona Financial Personal Loan. Determine which term and loan amount create your ideal payment. Remember to email yourself the results for quick access to the best solution.

- No Collateral Required

No need to use your car or home as collateral for this loan. This unsecured loan is granted based on your creditworthiness and promise to repay. - Fast Funding

Our local, quick decisions offer you the opportunity to apply for your personal loan today and receive funds quickly!

Your actual term and payment will be provided upon acceptance of an Arizona Financial loan. This calculator is for informational purposes only and its use does not guarantee an extension of credit.

How Do Personal Loans Work?

When you need funds for a big purchase or to consolidate debt, a personal loan or line of credit at Arizona Financial helps you reach your goal with personal loan terms of up to 60 months.

An Arizona Financial Personal Loan representative will help you determine the best loan option to cover the planned and unexpected scenarios that life has in store.

Complete your application and if you're approved, enjoy one lump sum being deposited directly into your account. You can use your money for anything!

- Cover unexpected bills or expenses

- Consolidate debt

- Make new memories

How Can Personal Loans Improve My Credit Score?

Your credit score impacts the amount of credit available to you and the interest rates you will have to pay when it comes time to borrow money. If you have a low credit score, you’ll have more difficulty finding affordable financing.

If you use a Personal Loan responsibly, you can build or establish a good repayment history and reduce your credit utilization ratio by consolidating your credit card debt, which can help in raising your credit score.

Peace of Mind with Debt Cancellation

When the unexpected happens, paying the bills can become a real burden. Make sure you and your family are protected with a debt cancellation plan from Arizona Financial!

- Covers your monthly payments or pays off your loan

- Protects your credit rating during difficult times

- Provides income during involuntary unemployment

Ask us about debt cancellation when applying for your loan or contact us for details.

I've been with Arizona Financial for nearly 20 years. They gave me a chance to rebuild my finances when the big banks wouldn't. I've financed three cars, my house, and a personal loan to pay off a credit card at half the interest rate. Every time I needed anything, they've been there for me with the right product and exceptional service. I'm financially in a far different place and now get offers from all kinds of financial institutions, but I will always go with the people who were there for me when nobody else was.

Terry R.

Arizona Financial MemberPersonal Loan Resources

What To Know About Buy Now, Pay Later Payment Plans

Buy now, pay later (BNPL) payment programs almost seem too good to be true. Discover when to choose and when to avoid these programs.

Read MoreShould I Consolidate My Debts?

Use this calculator to determine if consolidating your debt into one loan would be beneficial for you.

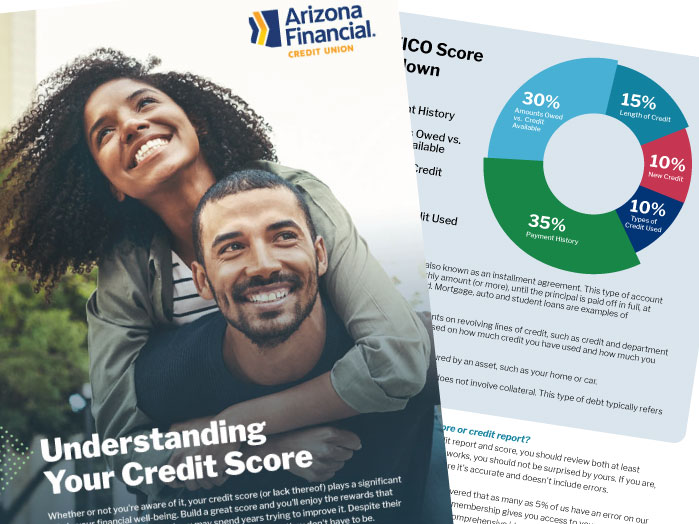

Calculate5 Ingredients In Your Credit Score

Discover how often you should check your credit, what factors make up your credit score, and what you can control to help your credit score number improve.

Read MoreHow Long Will It Take to Pay Off My Loan?

Use this calculator to determine how many payments it will take to pay off your loan.

CalculateSnowball vs. Avalanche: What’s the Best Way to Tackle Debt?

Two popular approaches for paying down debt are the Snowball Method and the Avalanche Method. Look at the pros and cons of each.

Read MoreHow Will Extra Payments Affect My Loan?

Use this calculator to see how extra payments will affect your loan.

CalculateBuilding a great Credit Score comes with great rewards

Understanding Your Credit Score

Inside the Guide

Credit scores don't need to be a mystery. Here's what we'll cover:

- What's a credit score?

- What's a FICO score?

- How can I improve my score?

Frequently Asked Questions

If I have bad credit, can I qualify for a loan?

Arizona Financial reviews a number of factors before making a decision on the loan, including credit and each member’s unique situation.

If you would like to discuss the details of your current financial picture before applying, simply call our loan experts at 602-683-1730.

How long does it take to get a personal loan?

A typical Personal Loan takes anywhere from 2-4 business days.

Do I have to be a member of Arizona Financial to get a loan?

To take advantage of Arizona Financial benefits, including competitive loan rates – membership is required. It's simple to become a member. You just have to meet one of our membership eligibility requirements.

Do you offer debt consolidation loans?

We have a number of options available for debt consolidation, including personal loans, home equity loans or even a first mortgage.

Our loan experts will review your unique financial situation to help you decide which options might best fits your needs.

If you would like to discuss options before applying, simply call our loan experts at 602-683-1730.