This Motorcycle Loan gets you on the road fast

Our low Motorcycle Loan rates and flexible terms can help get you on the road in no time!

Motorcycle Loan Rates

Whether you're looking to purchase a new or used motorcycle, our low rates make your new ride affordable.as low as

Amount

as low as

Amount

as low as

Amount

as low as

Amount

as low as

Amount

* Annual Percentage Rate. APR shown is the lowest available rate. Actual APR based on borrower’s credit history, year of vehicle and loan terms. Membership required based on eligibility. Loan payment example: $24.29 per month for each $1,000 borrowed at 7.74% APR for 48 months. Not all applicants may qualify.

* Annual Percentage Rate. APR shown is the lowest available rate. Actual APR based on borrower’s credit history, year of vehicle and loan terms. Membership required based on eligibility. Loan payment example: $24.29 per month for each $1,000 borrowed at 7.74% APR for 48 months. Not all applicants may qualify.

Get Started

- Apply online, get quick decision

- No application fee

- Financing for new and used motorcycles

- Flexible loan terms up to 84 months

Easy & Affordable Motorcycle Financing

Your loan stays local! Our loan underwriters are located right here in our neighborhood branches. That means fast decisions and a faster turnaround for you. Know what you can spend by getting preapproved before you shop.

Have confidence your monthly motorcycle loan payment will be affordable and consistent, even as the market changes.

Save your hard-earned money for more important things. Like new accessories for your new bike!

Ride easy knowing you have the ability to partially or fully, prepay your loan at any time without prepayment fees.

Motorcycles come in a variety of sizes and prices. We offer flexible, budget-friendly terms for all loan sizes.

OUR BEST MOTORCYCLE LOAN RATES - NEW OR USED

Motorcycle Loan Calculator

Explore estimated monthly Motorcycle Loan payments using different loan amounts and interest rates. When you find what works for your budget, you'll have an idea of how much to spend on your bike.

- Email yourself the results so you have them as you shop.

- To know exactly what you can spend, apply for pre-approval with our easy online application.

This calculator is for informational purposes only and its use does not guarantee an extension of credit.

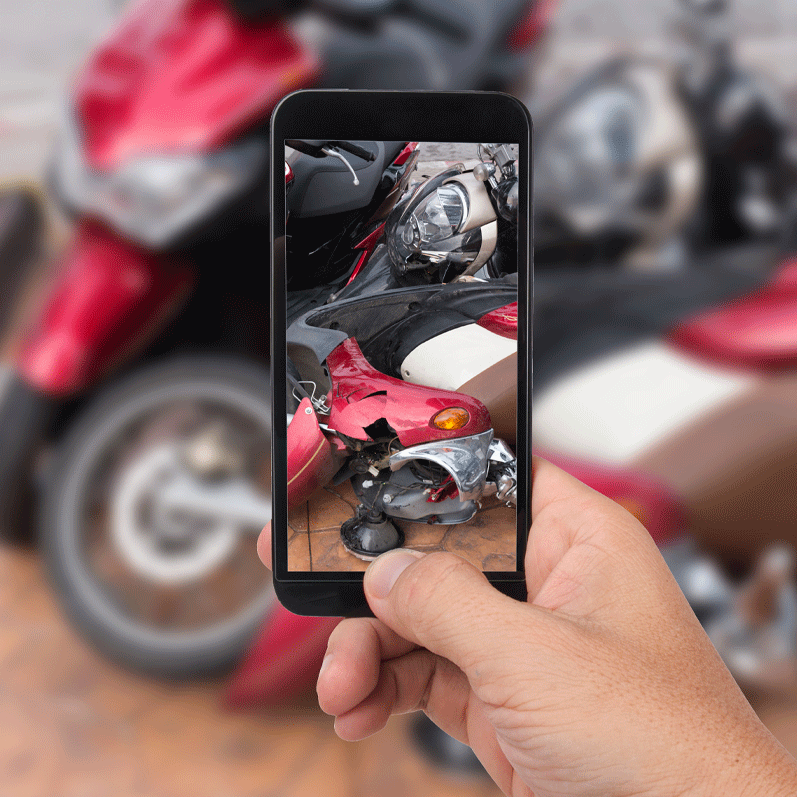

GAP Insurance

Your new motorcycle's value could depreciate quickly – sometimes faster than you can repay the loan. If your motorcycle is ever stolen or damaged beyond repair, a GAP policy helps cover the additional out-of-pocket expenses insurance won't cover.

- Provides a credit toward a replacement

- Covers the difference between what your insurance covers and what is still owed on the loan

- Cost can be included in your monthly motorcycle loan payment

Ask about a GAP policy when you apply for your motorcycle loan, or contact us for details.

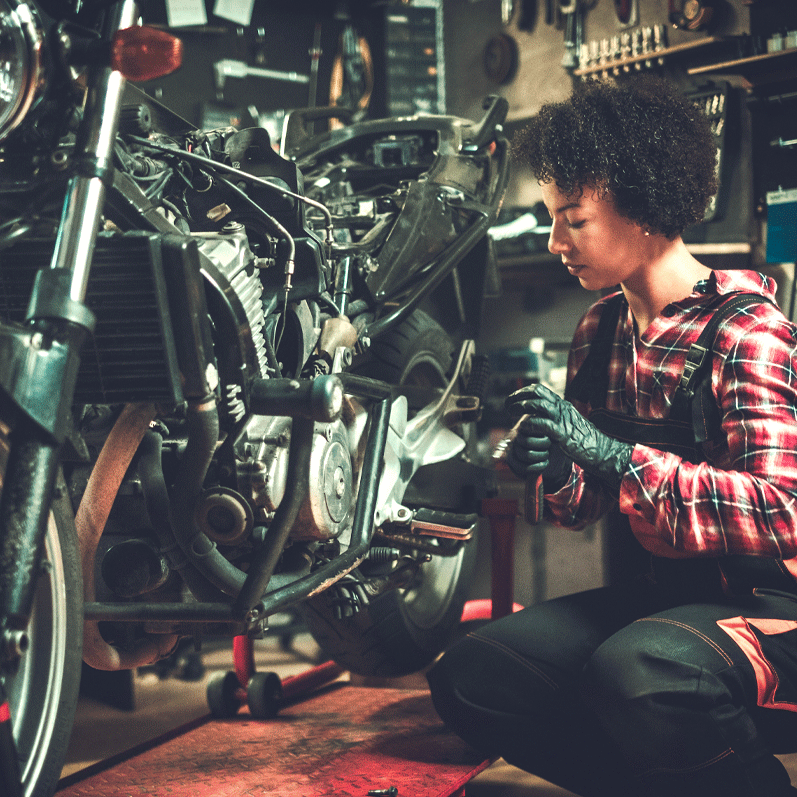

Motorcycle Extended Warranty

Our extended vehicle warranty, called Mechanical Breakdown Protection (MBP), picks up where the manufacturer’s warranty ends.

- No deductible

- Covers most out-of-pocket major repairs.

- Nationwide coverag.

- 24-hour emergency roadside assistance

- Rental car assistance

- Coverage is transferable when you sell your motorcycle

Ask about Mechanical Breakdown Protection when you apply for your motorcycle loan, or contact us for details.

Debt Cancellation

When the unexpected happens – like job loss, death or a serious injury or illness – paying the bills can become a real burden. Make sure you and your family are protected with a debt cancellation plan from Arizona Financial:

- Covers your monthly payments or pays off your loan.

- Protects your credit rating during difficult times.

- Provides income during involuntary unemployment.

Ask about Debt Cancellation when you apply for your motorcycle loan, or contact us for details.

Motorcycle Loan Resources

Should I Lease or Purchase a Car?

Use this calculator to calculate your monthly payments and total net cost. By comparing these amounts, you can determine which is the better for you.

Access CalculatorPros and Cons of New and Used Vehicles

Trying to decide if it’s better to buy a new car or a preowned car is a tough decision. To make your decision a little easier, we’ve outlined the pros and cons of each.

Read MoreExtended Warranties – Are They Worth the Cost?

We’ve all asked this question at some point. In some cases purchasing a warranty is a must-have, other times it may be a waste of money.

Read MoreShould I Accelerate My Loan Payments?

See how extra payments will affect your vehicle loan.

Access CalculatorHow Much Car Can I Afford?

Use this calculator to enter the monthly payment you are able to make.

Access CalculatorHow Much Will My Auto Payments Be?

Calculate your monthly car payments with this calculator.

Access CalculatorFrequently Asked Questions

How do I apply for a motorcycle loan at Arizona Financial?

Members can apply online, call 602-683-1000 or stop by one of our branch locations for assistance.

Do you offer debt cancellation?

Yes, Arizona Financial offers debt cancellation to help you when the unexpected happens – like job loss, death or a serious injury or illness. Learn more.

Do I have to be a credit union member to get a motorcycle loan

To take advantage of Arizona Financial benefits, including competitive loan rates – membership is required. It's simple to become a member.

You just have to meet one of our membership eligibility requirements.

Can I apply if I haven't found the motorcycle I want yet?

Yes! We’d love to help you get preapproved so you can shop for your motorcycle with confidence. You can get preapproved online, by calling 602-683-1000, or at any one of our branch locations.