Statement Regarding Recent Bank Closures

Message from Amy L. Hysell, Arizona Financial's President & CEO

Dear Member:

Across Arizona, people are reading of the news surrounding the closure of Silicon Valley Bank (SVB) in Santa Clara, California, on Friday, March 10, and subsequently the closure of Signature Bank in New York City over the following weekend. These events have caused a lot of headlines and media coverage, which we know may cause you to have questions.

In short, both financial institutions have unique business models. SVB concentrated heavily on startups financed by venture capitalists, and Signature Bank on crypto companies – both which are extremely risky. These business models are not representative of most banks and credit unions in the United States. We’re a very different financial institution than SVB or Signature Bank. We’re not exposed to tech start-ups or crypto currency.

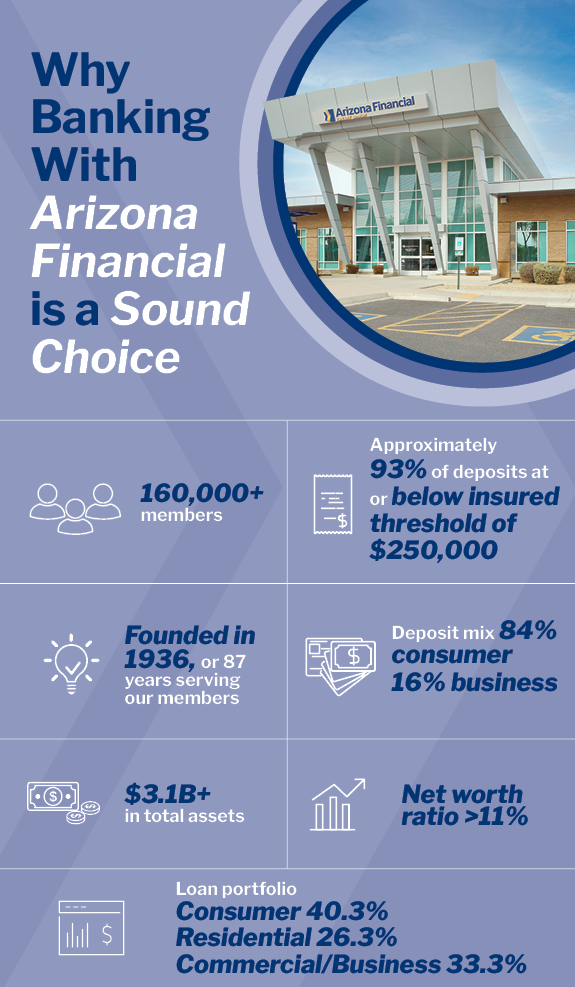

This is a good example of why where you choose to bank matters. Credit unions by nature do not take on the level of exposure and risk that these banks took on. In fact, Arizona Financial is not overly exposed to any one industry – this is intentional and something we monitor. The consumer members we serve work in hundreds of industries, and the businesses we serve operate in just about every category you can think of. The loans we make are strategically spread out by category – consumer (auto, credit cards), residential, and commercial to ensure diversification and minimize exposure to any one type of collateral.

As a member-owned cooperative, we also don’t have the market pressures of a publicly traded company that has to perform to a stock price.

Your funds on deposit remain federally insured up to $250,000. As an organization, approximately 93% of our member deposits are insured (balances at or under $250,000), which is another significant difference between Arizona Financial and SVB, or other financial institutions with a high concentration of large balance customers.

With an 87-year history of service, over $3.2 billion in assets, and a net worth ratio over 11% (significantly above the 7% necessary to be considered “well capitalized” by regulators), Arizona Financial is a strong financial institution. As member-owners, you can be assured we remain steadfast in our commitment to serving you and to ensuring your money is safe. Thank you for your membership.

To learn more about how your funds are insured by the National Credit Union Share Insurance Fund (NCUSIF), please visit the NCUA website.

Sincerely,

Amy Hysell

President & CEO